The Tari RFCs

Tari is a community-driven project. The documents presented in this RFC collection have typically gone through several iterations before reaching this point:

- Ideas and questions are posted in #tari-dev on #FreeNode IRC. This is typically short-form content with rapid feedback. Often, these conversations will lead to someone posting an issue or RFC pull request.

- RFCs are "Requests for Comment", so although the proposals in these documents are usually well-thought out, they are not cast in stone. RFCs can, and should, undergo further evaluation and discussion by the community. RFC comments are best made using Github issues.

New RFC's should follow the format given in the RFC template.

Lifecycle

RFCs go through the following lifecycle, which roughly corresponds to the COSS:

| Status | Description | |

|---|---|---|

| Draft |  | Changes, additions and revisions can be expected. |

| Stable |  | Typographical and cosmetic changes aside, no further changes should be made. Changes to the Tari code base w.r.t. a stable RFC will lead to the RFC becoming out of date, deprecated, or retired. |

| Out of date |  | This RFC has become stale due to changes in the code base. Contributions will be accepted to make it stable again if the changes are relatively minor, otherwise it should eventually become deprecated or retired. |

| Deprecated |  | This RFC has been replaced by a newer RFC document, but is still is use in some places and/or versions of Tari. |

| Retired |  | The RFC is no longer in use on the Tari network. |

RFC-0001/Overview

Overview of Tari Network

Maintainer(s): Cayle Sharrock

Licence

Copyright 2018 The Tari Development Community

Redistribution and use in source and binary forms, with or without modification, are permitted provided that the following conditions are met:

- Redistributions of this document must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the copyright holder nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

THIS DOCUMENT IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS", AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT HOLDER OR CONTRIBUTORS BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA OR PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, STRICT LIABILITY OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Language

The keywords "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY" and "OPTIONAL" in this document are to be interpreted as described in BCP 14 (covering RFC2119 and RFC8174) when, and only when, they appear in all capitals, as shown here.

Disclaimer

This document and its content are intended for information purposes only and may be subject to change or update without notice.

This document may include preliminary concepts that may or may not be in the process of being developed by the Tari community. The release of this document is intended solely for review and discussion by the community of the technological merits of the potential system outlined herein.

Goals

The aim of this proposal is to provide a very high-level perspective of the moving parts of the Tari protocol.

Related Requests for Comment

- RFC-0303: Digital asset network

- RFC-0131: Tari mining

- RFC-0201: TariScript

- RFC-0202: TariScript Opcodes

Description

Abstract

Tari's aims to be the most useful, decentralized platform that empowers anyone to create digitally scarce things people love.

This statement packages some important concepts.

To be useful, creators and users need to be able to interact with their digital assets in the way that they've been accustomed to in Web 2.0. This means that there is a safe, secure, responsive interface between human and the machines that manage their information. It means that the user experience is smooth and intuitive. It means that the network protocol itself is flexible and capable enough to provide every type of assets creators can imagine.

It also scales, so that the entire network does not become a victim of its own success and grind to a halt when more than a few hundred people actually try to use it.

Decentralisation is central to Tari's philosophy (pun intended). The tape is wearing thin on the newsreel that reports yet another centralised custodian, gatekeeper or "authority" becoming a single point of failure. This has led to thousands of people losing their crypto-assets, as well as their trust in the ideas of crypto-assets.

Tari has a strong focus on developer experience. The Tari community obsesses over building beautiful, clean, intuitive APIs and templates, which lead to beautiful developer tools. The idea is to widen the pool and allow anyone to create safe, secure, performant digital assets, rather than provide a gated community of rent-extracting "smart-contract developers".

In general, some of these goals are in direct opposition to each other. Speed, security and decentralisation typically form a trilemma that means that you need to settle for two out of the three.

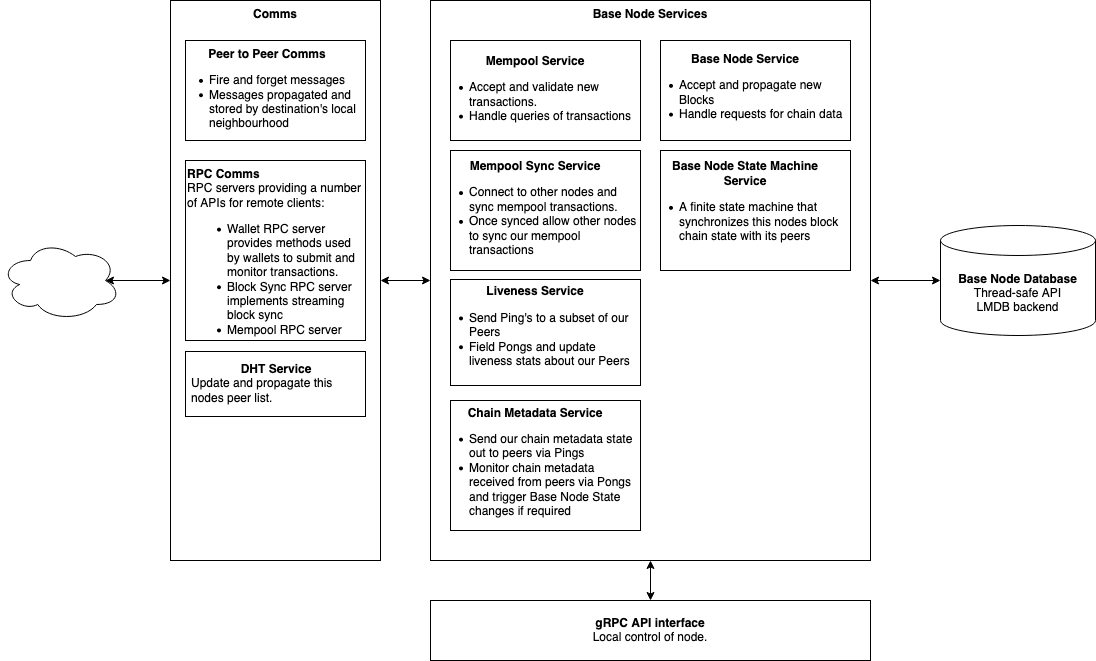

Tari attempts to resolve the dilemma by splitting operations over two discrete layers. Underpinning everything is a base layer that focuses on security and manages global state, and a second, digital assets layer that focuses on rapid finalisation and scalability.

Multiple Layers

The distributed system trilemma tells us that these requirements are mutually exclusive.

We can't have fast, cheap digital assets and also highly secure and decentralized currency tokens on a single system.

Tari overcomes this constraint by building two layers:

- A base layer that provides a public ledger of Tari coin transactions, secured by PoW to maximize security.

- A DAN consisting of a highly scalable, efficient side-chain that each manages the state of all digital asset.

The DAN layer gives up some security guarantees in exchange for performance. However, in the case of a liveness failure (wherein parts of the DAN cannot make progress), the base layer intervenes to break the deadlock and allow the DAN to continue.

Base Layer

The Tari base layer has the following primary features:

- PoW-based blockchain using Nakamoto consensus

- Transactions and blocks based on the Mimblewimble protocol

Mimblewimble is a blockchain protocol that offers some key advantages over other UTXO-based cryptocurrencies such as Bitcoin:

- Transactions are private. This means that casual observers cannot ascertain the amounts being transferred or the identities of the parties involved.

- Mimblewimble has a different set of security guarantees to Bitcoin. The upshot of this is that you can throw away UTXOs once they are spent and still verify the integrity of the ledger.

- Multi-signature transactions can be easily aggregated, making such transactions very compact, and completely hiding the parties involved, or the fact that there were multiple parties involved at all.

"Mimblewimble is the most sound, scalable 'base layer' protocol we know" -- @fluffypony

In addition to this, Tari has made some novel additions to the basic Mimblewimble protocol. Primarily, these were invented to allow the DAN to be built on top of Tari, but have found some great applications generally:

- TariScript. Similar to Bitcoin script, TariScript (RFC-201, RFC-202) provides limited "smart contract" functionality on the base layer protocol.

- One-sided payments. Vanilla Mimblewimble requires both sender and receiver to participate in the creation of transactions. It is impossible in MimblewimbleCoin, for example, to post a "tip jar" address and let people unilaterally send you funds. However, this is possible in Tari, thanks to TariScript.

- Stealth addresses. Want to allow people to send you funds using one-sided payments without revealing your public key (and thus, who you are) to the world? Stealth addresses have you covered.

- Covenants. Covenants allow you to construct complex chains of transactions that follow predefined rules.

- Burn transactions. Tari offers unequivocal "burn" transactions that render the burnt outputs permanently unspendable. This is an important mechanism that underpins the DAN economy.

Proof of Work

Tari is mined using a hybrid approach. On average, 50% of block rewards come from Monero merge-mining, while 50% come from the Sha3x algorithm. Blocks are produced every 2 minutes, on average.

The role of the base layer

The Base Layer fulfils these, and only these, major roles:

- It manages and enforces the accounting and consensus rules of the base Tari (XTR) token. This includes standard payments, and simple smart contracts such as one-sided payments and cross-chain atomic swaps.

- It maintains the Validator node register.

- Maintain a register of smart contract templates. This allows users to verify that digital assets are running the code that they expect and includes functionality like version tracking.

- Provides a global reference clock for the digital assets layer to help it resolve certain operational failure modes.

Digital Assets Network

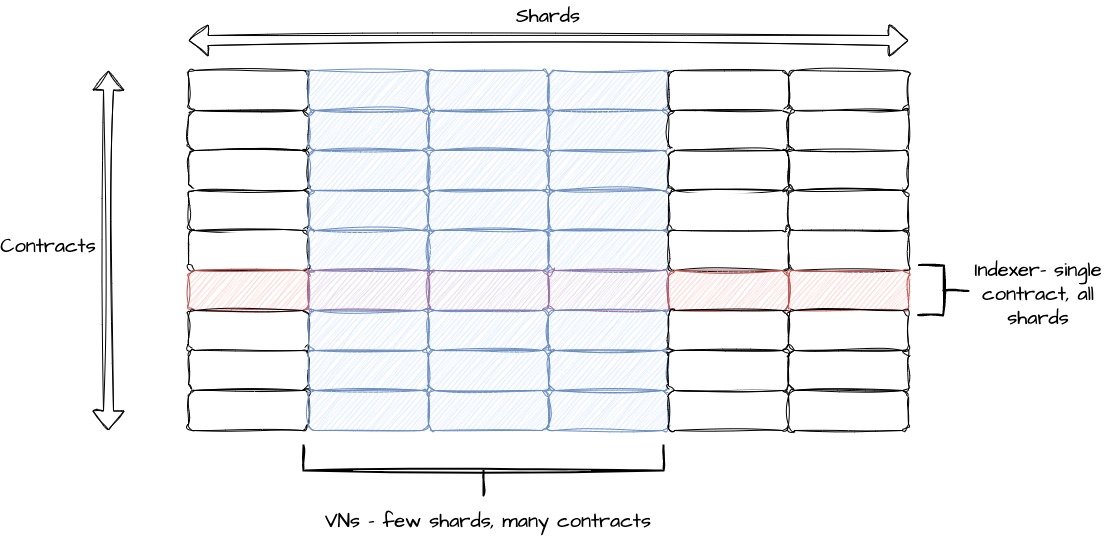

The DAN is focused on achieving high speed and scalability while maintaining a high degree of decentralisation.

The DAN itself is made up of two conceptual levels. On the more fundamental level, the consensus layer uses Cerberus and emergent HotStuff to reach consensus on state changes in the DAN in a highly scalable, decentralised way.

A big, and probably the biggest, advantage of this approach is that assets in disparate smart contracts can easily interact, without the need for slow, honey pot-shaped bridges.

Then there is the semantic layer, which is where the Tari contracts are compiled, run and verified inside sandboxed Tari virtual machines.

Together, these levels provide that smart contract enabled digital assets layer, that we've simply been calling the DAN.

Interplay of the layers

In general, the base layer knows nothing about the specifics of what is happening on the side-chain. It only cares that no Tari is created or destroyed, and that the flow of funds in and out of side chains are carried out by the appropriate authorised agents.

This is by design: the network cannot scale if details of digital asset contracts have to be tracked on the base layer. We envisage that there could be hundreds of thousands of contracts deployed on Tari. Some of those contracts may be enormous; imagine controlling every piece of inventory and their live statistics for a massively multiplayer online role-playing game (MMORPG). The base layer is also too slow. If any state relies on base layer transactions being confirmed, there is an immediate lag before that state change can be considered final, which kills the latency properties we seek for the DAN.

It is better to keep the two networks almost totally decoupled from the outset, and allow each network to play to its strength.

Change Log

| Date | Change | Author |

|---|---|---|

| 18 Dec 2018 | First outline | CjS77 |

| 30 Mar 2019 | First draft v0.0.1 | CjS77 |

| 19 Jun 2019 | Propose payment channel layer | CjS77 |

| 22 Jun 2021 | Remove payment channel layer proposal | SimianZa |

| 14 Jan 2022 | Update image. Expound on Base layer responsibilities | CjS77 |

| 10 Nov 2022 | Update overview for Cerberus | CjS77 |

| 09 Dec 2024 | Update percentage split for merge mining | Solivagant |

The Tari Base Layer

The Tari Base Layer network comprises the following major pieces of software:

- Base Layer full node implementation. The base layer full nodes are the consensus-critical pieces of software for the Tari base layer and cryptocurrency. The base nodes validate and transmit transactions and blocks, and maintain consensus about the longest valid proof-of-work blockchain.

- Peer-to-peer communications network. All blockchain systems need a messaging mechanism. The Tari project has built its own peer-to-peer, end-to-end encrypted, DHT-based communications platform. It utilises the Noise protocol and Tor to be highly secure and anonymous. Devices behind NATs and firewalls can use Tari's communication tools with ease.

- Mining software. Miners perform proof-of-work to secure the base layer and compete to submit the

next valid block into the Tari blockchain. Tari uses two Proof of Work (PoW) algorithms, the first is

merge-mined

with Monero, and the second is the native SHA3x algorithm.

The Tari source provides three alternatives for Tari miners:

- A standalone miner for SHA3 mining

- A merge-mining proxy to be used with XMRig to merge mine Tari with Monero

- Wallet software. Client software and Application Programming Interfaces (APIs) offering means to construct transactions, query nodes for information and maintain personal private keys. The reference design includes a wallet library, an C FFI interface, gRPC client and server code, a multi-platform console text-based wallet, and Aurora, the mobile wallet.

The RFCs in this section go into great describing how the various components work, and how they fit together to provide the backbone of the Tari ecosystem.

RFC-0110/BaseNodes

Base Layer Full Nodes (Base Nodes)

Maintainer(s): Cayle Sharrock, S W van heerden and Stanley Bondi

Licence

Copyright 2019 The Tari Development Community

Redistribution and use in source and binary forms, with or without modification, are permitted provided that the following conditions are met:

- Redistributions of this document must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the copyright holder nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

THIS DOCUMENT IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS", AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT HOLDER OR CONTRIBUTORS BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA OR PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, STRICT LIABILITY OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Language

The keywords "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY" and "OPTIONAL" in this document are to be interpreted as described in BCP 14 (covering RFC2119 and RFC8174) when, and only when, they appear in all capitals, as shown here.

Disclaimer

This document and its content are intended for information purposes only and may be subject to change or update without notice.

This document may include preliminary concepts that may or may not be in the process of being developed by the Tari community. The release of this document is intended solely for review and discussion by the community of the technological merits of the potential system outlined herein.

Goals

The aim of this Request for Comment (RFC) is to describe the roles that base nodes play in the Tari network as well as their general approach for doing so.

Related Requests for Comment

$$ \newcommand{\so}{\gamma} % script offset $$

Description

Broad Requirements

Tari Base Nodes form a peer-to-peer network for a proof-of-work based blockchain running the Mimblewimble protocol. The proof-of-work is performed via hybrid mining, that is merge mining with Monero and stand-alone SHA 3. Arguments for this design are presented in the overview.

Tari Base Nodes MUST carry out the following tasks:

- validate all Tari coin transactions;

- propagate valid transactions to peer nodes;

- validate all new blocks received;

- propagate validated new blocks to peer nodes;

- connect to peer nodes to catch up (sync) with their blockchain state;

- provide historical block information to peers that are syncing.

Once the Digital Assets Network (DAN) goes live, Base Nodes will also need to support the tasks described in RFC-0303_DAN. These requirements may involve but are not limited to:

- maintain an index of validator node registrations;

To carry out these tasks effectively, Base Nodes SHOULD:

- save the blockchain into an indexed local database;

- maintain an index of all Unspent Transaction Outputs (UTXOs);

- maintain a list of all pending, valid transactions that have not yet been mined (the mempool);

- manage a list of Base Node peers present on the network.

Tari Base Nodes MAY implement chain pruning strategies that are features of Mimblewimble, including transaction block compaction techniques.

Tari Base Nodes MAY also implement the following services via an Application Programming Interface (API) to clients:

- Block queries

- Kernel data queries

- Transaction queries

- Submission of new transactions

Such clients may include "light" clients, block explorers, wallets and Tari applications.

Transaction Validation and Propagation

Base nodes can be notified of new transactions by:

- connected peers;

- clients via APIs.

When a new transaction has been received, it is then passed to the mempool service where it will be validated and either stored or rejected.

The transaction is validated as follows:

- All inputs to the transaction are valid UTXOs in the UTXO set or are outputs in the current block.

- No inputs are duplicated.

- All inputs are able to be spent (they are not time-locked).

- All inputs are signed by their owners.

- All outputs have valid range proofs.

- No outputs currently exist in the current UTXO set.

- The transaction does not have timelocks applied, limiting it from being mined and added to the blockchain before a specified block height or timestamp has been reached.

- The transaction excess has a valid signature.

- The transaction weight does not exceed the maximum permitted in a single block as defined by consensus.

- The transaction excess is a valid public key. This proves that: $$ \Sigma \left( \mathrm{inputs} - \mathrm{outputs} - \mathrm{fees} \right) = 0 $$.

- The transaction excess has a unique value across the whole chain.

- The Tari script of each input must execute successfully and return the public key that signs the script signature.

- The script offset \( \so\) is calculated and verified as per RFC-0201_TariScript.

Rejected transactions are dropped without service interruption and noted in log files.

Timelocked transactions are rejected by the mempool. The onus is on the client to submit transactions once they are able to be spent.

Note: More detailed information is available in the timelocks RFC document.

Valid transactions are:

- added to the mempool;

- forwarded to peers using the transaction BroadcastStrategy.

Block/Transaction Weight

The weight of a transaction / block measured in "grams". Input, output and kernel weights reflect their respective relative storage and computation cost. Transaction fees are typically proportional to a transaction body's total weight, creating incentive to reduce the size of the UTXO set.

With a target block size of S and 1 gram to represent N bytes, we have

a maximum block weight of S/N grams.

With an S of 1MiB and N of 16, the block and transaction body weights are as follows:

| Byte size | Natural Weight | Adjust | Final | |

|---|---|---|---|---|

| Output | ||||

| - Per output | 832 | 52 | 0 | 52 |

| - Tari Script | variable | size_of(script) / 16 | 0 | size_of(script) / 16 |

| - Output Features | variable | size_of(features) / 16 | 0 | size_of(features) / 16 |

| Input | 169 | 11 | -2 | 9 |

| Kernel size | 113 | 8 | 2 | 10 |

Pseudocode:

output_weight = num_outputs * PER_OUTPUT_GRAMS(53)

foreach output in outputs:

output_weight += serialize(output.script) / BYTES_PER_GRAM

output_weight += serialize(output.features) / BYTES_PER_GRAM

input_weight = num_inputs * PER_INPUT_GRAMS(9)

kernel_weight = num_kernels * PER_KERNEL_GRAMS(10)

weight = output_weight + input_weight + kernel_weight

where the capitalized values are hard-coded constants.

Block Validation and Propagation

The block validation and propagation process is analogous to that of transactions. New blocks are received from the peer-to-peer network, or from an API call if the Base Node is connected to a Miner.

When a new block is received, it is passed to the block validation service. The validation service checks that:

- The block has not been processed before.

- Every transaction in the block is valid.

- The proof-of-work is valid.

- The block header is well-formed.

- The block is being added to the chain with the highest accumulated proof-of-work.

- It is possible for the chain to temporarily fork; Base Nodes SHOULD store orphaned forks up to some configured depth.

- It is possible that blocks may be received out of order. Base Nodes SHOULD keep blocks that have block heights greater than the current chain tip for some preconfigured period.

- The sum of all excesses is a valid public key. This proves that: $$ \Sigma \left( \mathrm{inputs} - \mathrm{outputs} - \mathrm{fees} \right) = 0$$.

- That all kernel excess values are unique for that block and the entire chain.

- Check if a block contains already spent outputs, reject that block.

- The Tari script of every input must execute successfully and return the public key that signs the script signature.

- The script offset \( \so\) is calculated and verified as per RFC-0201_TariScript.

Because Mimblewimble blocks can simply be seen as large transactions with multiple inputs and outputs, the block validation service checks all transaction verification on the block as well.

Rejected blocks are dropped silently.

Base Nodes are not obliged to accept connections from any peer node on the network. In particular:

- Base Nodes MAY refuse connections from peers that have been added to a denylist.

- Base Nodes MAY be configured to exclusively connect to a given set of peer nodes.

Validated blocks are

- added to the blockchain;

- forwarded to every connected base node peer using the block flood BroadcastStrategy.

In addition, when a block has been validated and added to the blockchain:

- The mempool MUST also remove all transactions that are present in the newly validated block.

- The UTXO set MUST be updated by removing all inputs in the block, and adding all the new outputs into it.

Peer Validation and Propagation

When a peer attempts to connect or is shared by a trusted peer the base node will perform a peer validation. Ensuring the peer has a valid id, signature, and peer address before adding or propagating the peer back to the network.

Synchronizing and Pruning of the Chain

Syncing and pruning are discussed in detail in RFC-0140.

Archival Nodes

Archival nodes are used to keep a complete history of the blockchain since genesis block. They do not employ pruning at all. These nodes will allow full syncing of the blockchain, because normal nodes will not keep the full history to enable this. These nodes must sync from another archival node.

Pruned Nodes

Pruned nodes take advantage of the cryptography of mimblewimble to allow them to prune spent inputs and outputs beyond the pruning horizon and still validate the integrity of the blockchain i.e. no coins were destroyed or created beyond what is allowed by consensus rules. A sufficient number of blocks back from the tip should be configured because reorgs are no longer possible beyond that horizon. These nodes can sync from any other base node (archival and pruned).

Change Log

| Date | Change | Author |

|---|---|---|

| 07 Jan 2019 | First draft | CjS77 |

| 25 Jan 2019 | Pruning and cut-through | SWvheerden |

| 07 Feb 2021 | Syncing | SWvheerden |

| 23 Sep 2021 | Block weights | sbondi |

| 19 Oct 2022 | Stabilizing updates | brianp |

RFC-0111/BaseNodesArchitecture

Base Node Architecture

Maintainer(s): Cayle Sharrock

Licence

Copyright 2022 The Tari Development Community

Redistribution and use in source and binary forms, with or without modification, are permitted provided that the following conditions are met:

- Redistributions of this document must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the copyright holder nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

THIS DOCUMENT IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS", AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT HOLDER OR CONTRIBUTORS BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA OR PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, STRICT LIABILITY OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Language

The keywords "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY" and "OPTIONAL" in this document are to be interpreted as described in BCP 14 (covering RFC2119 and RFC8174) when, and only when, they appear in all capitals, as shown here.

Disclaimer

This document and its content are intended for information purposes only and may be subject to change or update without notice.

This document may include preliminary concepts that may or may not be in the process of being developed by the Tari community. The release of this document is intended solely for review and discussion by the community of the technological merits of the potential system outlined herein.

Goals

The aim of this Request for Comment (RFC) is to describe the high-level Base Node architecture.

Architectural Layout

The Base Node architecture is designed to be modular, robust and performant.

The major components are separated into separate modules. Each module exposes a public Application Programming Interface (API), which communicates with other modules using asynchronous messages via futures.

Base Node Service

The Base Node Service fields requests for the local nodes chain state and also accepts newly mined blocks that are propagating across the network. The service subscribes to NewBlock and BaseNodeRequest messages via the P2P comms interface. These messages are propagated across the P2P network and can also be received directly from other nodes. The service also provides a local interface to its functionality via an asynchronous Request-Response API.

The P2P message types this service subscribes to are:

-

NewBlock: A newly mined block is being propagated over the network. If the node has not seen the block before, the node will validate it. Its action depends on the validation outcome:

- Invalid block - drop the block.

- Valid block appending to the longest chain - add the block to the local state and propagate the block to peers.

- Valid block forking off main chain - add the block to the local state and propagate the block to peers.

- Valid block building off unknown block - add the orphan block to the local state.

-

BaseNodeServiceRequest: A collection of requests for chain data from the node.

Base Node State Machine Service

This service is essentially a finite state machine that synchronises its blockchain state with its peers. When the state machine decides it needs to synchronise its chain state with a peer it uses the Base Node Sync RPC service to do so. The RPC service allows for streaming of headers and blocks in a far more efficient manner than using the P2P messaging.

This service does not provide a local API but does provide an event stream and Status Info watch channel for other modules to subscribe to.

Mempool and Mempool Sync Services

The mempool service tracks valid transactions that the node knows about, but that have not yet been included in a block. The mempool is ephemeral and non-consensus critical, and as such may be a memory-only data structure. Maintaining a large mempool is far more important for Base Nodes serving miners than those serving wallets. The mempool structure itself is a set of hash maps as described in RFC-0190

When either the node reboots, or it synchronises a default number of 5 blocks, the Mempool sync service will contact peers and sync valid mempool transactions from them. After it has synced this service runs to field such requests from other peers.

The Mempool service handles Mempool Service Requests which it can receive from the P2P comms stack via its subscriptions, via the Mempool RPC service and via an internal Request-Response API. All these interfaces provide the following calls:

- SubmitTransaction: Submit a transaction to be validated and included in the mempool. If the transaction is invalid it will be rejected with a reason.

- GetTxStateByExcess: Request the state of a transaction if it exists in the mempool using its excess signature

- GetStats and getState: Request information about the current status of the mempool.

Liveness Service

The Liveness service can be used by other modules to test the liveness of a specific peer and also periodically tests a

set of its connected peers for liveness. This service subscribes to Ping P2P messages and responds with Pongs. The

service gathers data about the monitored peer's liveness such as its latency. The Ping and Pong` messages also contain

a copy of this nodes current Chain Metadata for use by the receiving nodes Chain Metadata Service.

Chain Metadata Service

The Chain Metadata Service maintains this nodes current Chain Metadata state to be sent out via Ping and Pong

messages by the Liveness service. This node also monitors the Chain Metadata received from other peers in the Ping and

Pong messages received by the Liveness service. Once a full round of Pong messages are received this service will

emit this data as an event which the Base Node State Machine monitors.

Distributed Hash Table (DHT) Service

Peer discovery is a key service that blockchain nodes provide so that the peer mesh network can be navigated by the full nodes making up the network.

In Tari, the peer-to-peer network is not only used by full nodes (Base Nodes), but also by Validator Nodes, and Tari and Digital Assets Network (DAN) clients.

For this reason, peer management is handled internally by the Comms layer. If a Base Node wants to propagate a message,

new block or transaction, for example, it simply selects a BROADCAST strategy for the message and the Comms layer

will do the rest.

When a node wishes to query a peer for its peer list, this request will be handled by the DHTService. It will

communicate with its Comms module's Peer Manager, and provide that information to the peer.

Blockchain Database

The blockchain database module is responsible for providing a persistent storage solution for blockchain state data. This module is used by the Base Node Service, Base Node State Machine, Mempool Service and the RPC servers. For Tari, this is delivered using the Lightning Memory-mapped Database (LMDB). LMDB is highly performant, intelligent and straightforward to use. An LMDB is essentially treated as a hash map data structure that transparently handles memory caching, disk Input/Output (I/O) and multi-threaded access. This module is shared by many services and so must be thread-safe.

Communication Interfaces

P2P communications

The Tari Peer to Peer messaging protocol is defined in RFC-0172. It is a fire-and-forget style protocol. Messages can be sent directly to a known peer, sent indirectly to an offline or unknown peer and broadcast to a set of peers. When a message is sent to specific peer it is propagated to the peers local neighbourhood and stored by those peers until it comes online to receive the message. Messages that are broadcast will be propagated around the network until the whole network has received them, they are not stored.

RPC Services

Fire-and-forget messaging is not efficient for point to point communications between online peers. For these applications the Base Node provides RPC services that present an API for clients to interact with. These RPC services provide a Request-Response interface defined by Profobuf for clients to use. RPC also allows for streaming of data which is much more efficient when transferring large amounts of data.

Examples of RPC services running in Base Node are:

- Wallet RPC service: An RPC interface containing methods used by wallets to submit and query transactions on a Base Node

- Base Node Sync RPC Service: Used by the Base Node State Machine Service to synchronise blocks

- Mempool RPC Service: Provides the Mempool Service API via RPC

gRPC Interface

Base Nodes need to provide a local communication interface in addition to the P2P and RPC communication interface. This is best achieved using gRPC. The Base Node gRPC interface provides access to the public API methods of the Base Node Service, the mempool module and the blockchain state module, as discussed above.

gRPC access is useful for tools such as local User Interfaces (UIs) to a running Base Node; client wallets running on the same machine as the Base Node that want a more direct communication interface to the node than the P2P network provides; third-party applications such as block explorers; and, of course, miners.

A non-exhaustive list of methods the base node module API will expose includes:

- Blockchain state calls, including:

- checking whether a given Unspent Transaction Output (UTXO) is in the current UTXO set;

- requesting the latest block height;

- requesting the total accumulated work on the longest chain;

- requesting a specific block at a given height;

- requesting the Merklish root commitment of the current UTXO set;

- requesting a block header for a given height;

- requesting the block header for the chain tip;

- validating signatures for a given transaction kernel;

- validating a new block without adding it to the state tree;

- validating and adding a (validated) new block to the state, and informing of the result (orphaned, fork, reorg, etc.).

- Mempool calls

- The number of unconfirmed transactions

- Returning a list of transaction ranked by some criterion (of interest to miners)

- The current size of the mempool (in transaction weight)

- Block and transaction validation calls

- Block synchronisation calls

Change Log

| Date | Change | Author |

|---|---|---|

| 2 Jul 2019 | First outline | CjS77 |

| 11 Aug 2019 | Updates | CjS77 |

| 15 Jun 2021 | Significant updates | SimianZa |

| 11 Sep 2022 | Minor update | JorgeAnt |

| 18 Jan 2023 | Minor update | JorgeAnt |

RFC-0120/Consensus

Base Layer Consensus

Maintainer(s): Cayle Sharrock, Stanley Bondi and SW van heerden

Licence

Copyright 2019 The Tari Development Community

Redistribution and use in source and binary forms, with or without modification, are permitted provided that the following conditions are met:

- Redistributions of this document must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the copyright holder nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

THIS DOCUMENT IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS", AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT HOLDER OR CONTRIBUTORS BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA OR PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, STRICT LIABILITY OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Language

The keywords "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY" and "OPTIONAL" in this document are to be interpreted as described in BCP 14 (covering RFC2119 and RFC8174) when, and only when, they appear in all capitals, as shown here.

Disclaimer

This document and its content are intended for information purposes only and may be subject to change or update without notice.

This document may include preliminary concepts that may or may not be in the process of being developed by the Tari community. The release of this document is intended solely for review and discussion by the community of the technological merits of the potential system outlined herein.

Goals

The aim of this Request for Comment (RFC) is to describe the fields that a block should contain as well as all consensus rules that will determine the validity of a block.

Related Requests for Comment

Description

Blockchain consensus is a set of rules that a majority of nodes agree on that determines the state of the blockchain.

This RFC details the consensus rules for the Tari network.

Blocks

Every block MUST:

-

have exactly one valid block header, as per the Block Headers section

-

have exactly one coinbase transaction

-

have a total transaction weight less than the consensus maximum

-

be able to calculate matching Merkle roots (kernel_mr, output_mr, witness_mr, and input_mr)

-

each transaction input MUST:

- be of an allowed transaction input version

- spend an existing valid UTXO with a maturity less than the current block height

- satisfy the covenant attached to the UTXO

- have a valid script signature

- be in a canonical order (see Transaction ordering)

-

each transaction output MUST:

- be of an allowed transaction output version

- have a unique domain separated hash (

version || features || commitment || script || covenant || encrypted_values) with the domain (transaction_output) - have a unique commitment in the current UTXO set

- be in a canonical order (see Transaction ordering)

- have a valid range proof

- have a valid metadata signature

- contain only allowed opcodes in the script

-

each transaction kernel MUST

- have a valid kernel excess signature

- have a unique excess

-

have a valid total script offset, \( \gamma \), see script-offset.

-

the number of

BURNEDoutputs MUST equal the number ofBURNED_KERNELkernels exactly, -

the commitment values of each burnt output MUST match the commitment value of each corresponding

BURNED_KERNELexactly. -

the transaction commitments and kernels MUST balance, as follows:

$$ \begin{align} &\sum_i\mathrm{Cout_{i}} - \sum_j\mathrm{Cin_{j}} + \text{fees} \cdot H \stackrel{?}{=} \sum_k\mathrm{K_k} + \text{offset} \\ & \text{for each output}, i, \\ & \text{for each input}, j, \\ & \text{for each kernel excess}, k \\ & \text{and }\textit{offset }\text{is the total kernel offset} \\ \end{align} \tag{1} $$

If a block does not conform to the above, the block SHOULD be discarded and MAY ban the peer that sent it.

Coinbase

A coinbase transaction contained in a block MUST:

- be the only transaction in the block with the coinbase flag

- consist of exactly one output and one kernel (no input)

- have a valid kernel signature

- have a value exactly equal to the emission at the block height it was minted (see emission schedule) plus the total transaction fees within the block

- have a lock-height as per consensus

- can not have a offset except 0

- can not have a script offset except 0

A coinbase transaction contained in a block CAN:

- include any arbitrary 64 bytes of extra data, coinbase-extra

Block Headers

Every block header MUST contain the following fields:

- version;

- height;

- prev_hash;

- timestamp;

- output_mr;

- output_mmr_size;

- input_mr;

- witness_mr;

- kernel_mr;

- kernel_mmr_size;

- total_kernel_offset;

- script_kernel_offset;

- nonce;

- pow.

The block header MUST conform to the following:

- The nonce and PoW must be valid for the block header.

- The [achieved difficulty] MUST be greater than or equal to the target difficulty.

- The FTL and MTP rules, detailed below.

- The block hash must not appear in the bad block list.

The Merkle roots are validated as part of the full block validation, detailed in Blocks.

If the block header does not conform to any of the above, the block SHOULD be rejected and MAY ban the peer that sent it.

Version

This is the version currently running on the chain.

The version MUST conform to the following:

- It is represented as an unsigned 16-bit integer.

- Version numbers MUST be incremented whenever there is a change in the blockchain schema or validation rules starting from 0.

- The version must be one of the allowed versions for the consensus rules at this block's height.

Height

A counter indicating how many blocks have passed since the genesis block (inclusive).

The height MUST conform to the following:

- Represented as an unsigned 64-bit integer.

- The height MUST be exactly one more than the block referenced in the

prev_hashblock header field. - The genesis block MUST have a height of 0.

Prev_hash

This is the hash of the previous block's header.

The prev_hash MUST conform to the following:

- represented as an array of unsigned 8-bit integers (bytes) in little-endian format.

- MUST be a hash of the entire contents of the previous block's header using the domain (

block_header).

Timestamp

This is the timestamp at which the block was mined.

The timestamp MUST conform to the following:

Output_mr

The output_mr MUST be calculated as follows: Hash (TXO MMR root || Hash(spent TXO bitmap)).

The TXO MMR root is the MMR root that commits to every transaction output that has ever existed since

the genesis block.

The spent TXO bitmap is a compact serialized roaring bitmap containing all the output MMR leaf indexes

of all the outputs that have ever been spent.

The output_mr MUST conform to the following:

- Represented as an array of unsigned 8-bit integers (bytes) in little-endian format.

- The hashing function used MUST be blake2b with a 256-bit digest.

Output_mmr_size

This is the total size of the leaves in the output Merkle mountain range.

The Output_mmr_size MUST conform to the following:

- Represented as a single unsigned 64-bit integer.

Input_mr

This is the Merkle root of all the inputs in the block, which consists of the hashed inputs. It is used to prove that all inputs are correct and not changed after mining. This MUST be constructed by adding, in order, the hash of every input contained in the block.

The input_mr MUST conform to the following:

- Represented as an array of unsigned 8-bit integers (bytes) in little-endian format.

- The hashing function must be blake2b with a 256-bit digest.

Witness_mr

This is the Merkle root of the output witness data, specifically all created outputs’ range proofs and

metadata signatures. This MUST be constructed by

Hash ( RangeProof || metadata commitment signature), in order, for every output contained in the block.

The witness_mr MUST conform to the following:

- Represented as an array of unsigned 8-bit integers (bytes) in little-endian format.

- The hashing function used must be blake2b with a 256-bit digest.

Kernel_mr

This is the Merkle root of the kernels.

The kernel_mr MUST conform to the following:

- Must be transmitted as an array of unsigned 8-bit integers (bytes) in little-endian format.

- The hashing function used must be blake2b with a 256-bit digest.

Kernel_mmr_size

This is the total size of the leaves in the kernel Merkle mountain range.

The Kernel_mmr_size MUST conform to the following:

- Represented as a single unsigned 64-bit integer.

Total_kernel_offset

This is the total summed offset of all the transactions in this block.

The total_kernel_offset MUST conform to the following:

- Must be transmitted as an array of unsigned 8-bit integers (bytes) in little-endian format

Total_script_offset

This is the total summed script offset of all the transactions in this block.

The total_script_offset MUST conform to the following:

- Must be transmitted as an array of unsigned 8-bit integers (bytes) in little-endian format

Nonce

This is the nonce used in solving the Proof of Work.

The nonce MUST conform to the following:

- MUST be transmitted as an unsigned 64-bit integer;

- for RandomX blocks, thus MUST be 0

PoW

This is the Proof of Work algorithm used to solve the Proof of Work. This is used in conjunction with the Nonce.

The [PoW] MUST contain the following:

- pow_algo as an enum (0 for RandomX, 1 for Sha3x).

- pow_data for RandomX blocks as an array of unsigned 8-bit integers (bytes) in little-endian format, containing the RandomX merge-mining Proof-of-Work data.

- the RandomX seed, stored as

randomx_keywithin the RandomX block, must have not been first seen in a block with confirmations more thanmax_randomx_seed_height.

- the RandomX seed, stored as

- pow_data for Sha3x blocks MUST be empty.

Difficulty Calculation

The target difficulty represents how difficult it is to mine a given block. This difficulty is not fixed and needs to constantly adjust to changing network hash rates.

The difficulty adjustment MUST be calculated using a linear-weighted moving average (LWMA) algorithm (2) $$ \newcommand{\solvetime}{ \mathrm{ST_i} } \newcommand{\solvetimemax}{ \mathrm{ST_{max}} } $$

| Symbol | Value | Description |

|---|---|---|

| N | 90 | Target difficulty block window |

| T | SHA3x: 300 RandomX: 200 | Target block time in seconds. The value used depends on the PoW algorithm being used. |

| \( \solvetimemax \) | SHA3x: 1800 RandomX: 1200 | Maximum solve time. This is six times the target time of the current PoW algorithm. |

| \( \solvetime \) | variable | The timestamp difference in seconds between block i and i - 1 where \( 1 \le \solvetime \le \solvetimemax \) |

| \( \mathrm{D_{avg}} \) | variable | The average difficulty of the last N blocks |

$$ \begin{align} & \textit{weighted_solve_time} = \sum\limits_{i=1}^N(\solvetime*i) \\ & \textit{weighted_target_time} = (\sum\limits_{i=1}^Ni) * \mathrm{T} \\ & \textit{difficulty} = \mathrm{D_{avg}} * \frac{\textit{weighted_target_time}}{\textit{weighted_solve_time}}\\ \end{align} \tag{2} $$

It is important to note that the two proof of work algorithms are calculated independently. i.e., if the current block uses SHA3x proof of work, the block window and solve times only include SHA3x blocks and vice versa.

FTL

The Future Time Limit. This is how far into the future a time is accepted as a valid time. Any time that is more than the FTL is rejected until such a time that it is not more than the FTL. The FTL is calculated as (T*N)/20 with T and N defined as: T: Target time - This is the ideal time that should pass between blocks that have been mined. N: Block window - This is the number of blocks used when calculating difficulty adjustments.

MTP

The Median Time Passed (MTP) is the lower bound calculated by taking the median average timestamp of the last N blocks. Any block with a timestamp that is less than MTP will be rejected.

Total accumulated proof of work

This is defined as the total accumulated proof of work done on the blockchain. Tari uses two independent proof of work algorithms rated at different difficulties. To compare them, we simply multiply them together into one number: $$ \begin{align} \textit{accumulated_randomx_difficulty} * \textit{accumulated_sha3x_difficulty} \end{align} \tag{3} $$ This value is used to compare chain tips to determine the strongest chain.

Transaction Ordering

The order in which transaction inputs, outputs, and kernels are added to the Merkle mountain range completely changes the final Merkle root. Input, output, and kernel ordering within a block is, therefore, part of the consensus.

The block MUST be transmitted in canonical ordering. The advantage of this approach is that sorting does not need to be done by the whole network, and verification of sorting is exceptionally cheap.

- Transaction outputs are sorted lexicographically by the byte representation of their Pedersen commitment i.e. ( \(k \cdot G + v \cdot H\) ).

- Transaction kernels are sorted lexicographically by the excess signature byte representation.

- Transaction inputs are sorted lexicographically by the hash of the output that is spent by the input.

Change Log

| Date | Change | Author |

|---|---|---|

| 11 Oct 2022 | First stable | SWvHeerden |

| 13 Mar 2023 | Add mention of coinbase extra | SWvHeerden |

| 05 Jun 2023 | Add coinbase excess rule | SWvHeerden |

| 01 Aug 2023 | Add Randomx rule, fix Sha and Monero names | SWvHeerden |

RFC-0131/Mining

Full-node Mining on Tari Base Layer

Maintainer(s): Hansie Odendaal

Licence

Copyright 2020 The Tari Development Community

Redistribution and use in source and binary forms, with or without modification, are permitted provided that the following conditions are met:

- Redistributions of this document must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the copyright holder nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

THIS DOCUMENT IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS", AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT HOLDER OR CONTRIBUTORS BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA OR PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, STRICT LIABILITY OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Language

The keywords "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY" and "OPTIONAL" in this document are to be interpreted as described in BCP 14 (covering RFC2119 and RFC8174) when, and only when, they appear in all capitals, as shown here.

Disclaimer

This document and its content are intended for information purposes only and may be subject to change or update without notice.

This document may include preliminary concepts that may or may not be in the process of being developed by the Tari community. The release of this document is intended solely for review and discussion by the community of the technological merits of the potential system outlined herein.

Goals

This document describes the final proof-of-work strategy proposal for Tari main net.

Related Requests for Comment

This RFC replaces and deprecates RFC-0130: Mining

Description

The following proposal draws from many of the key points of debate from the Tari community on the topic of Tari’s main chain proof of work strategy. The early working assumption was that Tari would be 100% merged mined by Monero.

Having a single, merge mined Proof of Work (PoW) algorithm would be nice, but the risks of hash rate attacks are real and meaningful. Double-spends and altering history can happen with >50% hash power, while selfish mining and eclipse attacks can happen with >33% hash power for a poorly connected attacker and >25% for a well-connected attacker (see Merged Mining: Analysis of Effects and Implications). Any non-merge mined PoW algorithm that is currently employed is even more vulnerable, especially if one can simply buy hash rate on platforms like NiceHash.

Hybrid mining is a strategy that apportions blocks across multiple PoW algorithms. If the hybrid algorithms are independent, then one can get at most x% of the total hash rate, where x is the fraction of blocks apportioned to that algorithm. As a result, the threat of a double-spend or selfish mining attack is mitigated, and in some cases eliminated.

This proposal puts forward Hybrid mining as the Tari PoW algorithm.

The choice of algorithms

In hybrid mining, "independence" of algorithms is key. If the same mining hardware can be used on multiple PoW algorithms in the hybrid mining scheme, you may as well not bother with hybrid mining because miners can simply switch between them.

In practice, no set of algorithms is genuinely independent. The best we can do is try to choose algorithms that work best on CPUs, GPUs, and ASICs. In truth, the distinction between GPUs and ASICs is only a matter of time. Any "GPU-friendly" algorithm is ASIC-friendly, too; it's just a case of whether the capital outlay for fabricating them is worth it, and this will eventually become true for any algorithm that supplies PoW for a growing market cap.

With this in mind, we should only choose one GPU/ASIC algorithm and one for CPUs.

An excellent technical choice would be merge mining with Monero using RandomX as a CPU-only algorithm and SHA3, also known as Keccak , for a GPU/ASIC-friendly algorithm. Using a custom configuration of such a simple and well-understood algorithm means there is a low likelihood of unforeseen optimizations that will give a single miner a considerable advantage. It also means that it stands a good chance of being "commoditized" when ASICs are eventually manufactured. This would mean that SHA3 ASICs are widely available from multiple suppliers.

The difficulty adjustment strategy

The choice of difficulty adjustment algorithm is important. In typical hybrid mining strategies, each algorithm operates completely independently with a scaled target block time. Tari testnet has been running very successfully using the Linear Weighted Moving Average (LWMA) from Bitcoin & Zcash Clones version 2018-11-27. This LWMA difficulty adjustment algorithm has also been tested in simulations, and it proved to be a good choice in the multi-PoW scene as well.

Final proposal, hybrid mining details

Tari's proof-of-work mining algorithm is summarized below:

- Two mining algorithms, with an average combined target block time of 120 s, to match Monero's block interval.

- A log-weighted moving average difficulty adjustment algorithm using a window of 90 blocks.

Tari mining hash

First, the block header is hashed with the 256-bit Blake2b hashing algorithm using

domain-separated hashing, using the domain

com.tari.base_layer.core.blocks. The fields are hashed in the order:

- version

- block height

- previous header hash

- timestamp

- input Merkle root

- output Merkle root

- output Merkle mountain range size

- witness Merkle root

- kernel Merkle root

- kernel Merkle mountain range size

- total kernel offset

- total script offset

This hash is used in both the SHA-3 and RandomX proof-of-work algorithms. The header version for the Tari Genesis block is 1.

RandomX

Monero blocks that are merge-mining Tari MUST include the Tari mining hash in the extra field of the Monero coinbase transaction.

Tari also imposes the following consensus rules:

- The

seed_hashMUST only be used for 3000 blocks, after which a block MUST be discarded if it's used again. - The little-endian difficulty MUST be equal to or greater than the target for that block as determined by the LWMA for Tari.

- The LWMA MUST use a target time of 200 seconds.

- MUST set the header field PoW:pow_algo as 0 for a Monero block

- MUST encode the following data into the Pow:Pow_data field:

- Monero BlockHeader,

- RandomX VM key,

- Monero transaction count,

- Monero merkle root,

- Monero coinbase merkle proof and,

- Monero coinbase transaction

Sha-3x

Tari's independent proof-of-work algorithm is very straightforward.

Calculate the triple hash of the following input data:

- Nonce (8 bytes)

- Tari mining hash (32 bytes)

- PoW record (for Sha-3x, this is always a single byte of value 1)

That is, the nonce in little-endian format, mining hash and the PoW record are chained together and hashed by the Keccak Sha3-256 algorithm. The result is hashed again, and this result is hashed a third time. The result of the third hash is compared to the target value of the current block difficulty.

If the entire 64-bit nonce space is exhausted without finding a valid block, the mining algorithm must request a new Tari mining hash from the Tari base node. The simplest way to do this is to update the timestamp field in the block header, keeping everything else constant.

Tari imposes the following consensus rules:

- The Big endian difficulty MUST be equal or greater than the target difficulty for that block as determined by the

LWMA for Tari. The difficulty and target are related by the equation

difficulty = (2^256 - 1) / target. - MUST set the header field PoW:pow_algo as 1 for a Sha block.

- The PoW:pow_data field is empty

- The LWMA MUST use a target time of 300 seconds.

A triple hash is selected to keep the requirements on hardware miners (FPGAs, ASICs) fairly low. But we also want to avoid making the proof-of-work immediately "NiceHashable". There are several coins that already use a single or double SHA3 hash, and we'd like to avoid having that hashrate immediately deployable against Tari.

Historical note: In general, little-endian representations for integers are used in Tari. There are a few places where big-endian representations are used, in the PoW hash and in some merge-mined fields in particular. The latter is required to be compatible with the Monero specification. But we also use the big-endian representation for the block hash due to a historical convention. The Bitcoin white paper describes the block hash target as containing "a certain number of leading zeros" (paraphrased). This is obviously a big-endian representation. If we used little-endian, our block hashes would have trailing zeroes. So we use the big-endian form to satisfy the expected in block explorers and such that block hashes should always start with a series of zeroes.

Stabilisation note

This RFC is stable as of PR#4862

Change Log

| Date | Change | Author |

|---|---|---|

| 2022-11-25 | Update mining hash decsription | CjS77 |

| 2022-10-26 | Finalise SHA-3 algorithm | CjS77 |

| 2022-10-11 | First outline | SWvHeerden |

| 2024-12-09 | Corrected percentages for merged and hybrid mining | Solivagant |

RFC-0132/MergeMiningMonero

Tari protocol for Merge Mining with Monero

Maintainer(s): Stanley Bondi

Licence

Copyright 2020 The Tari Development Community

Redistribution and use in source and binary forms, with or without modification, are permitted provided that the following conditions are met:

- Redistributions of this document must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the copyright holder nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

THIS DOCUMENT IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS", AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT HOLDER OR CONTRIBUTORS BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA OR PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, STRICT LIABILITY OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Language

The keywords "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY" and "OPTIONAL" in this document are to be interpreted as described in BCP 14 (covering RFC2119 and RFC8174) when, and only when, they appear in all capitals, as shown here.

Disclaimer

This document and its content are intended for information purposes only and may be subject to change or update without notice.

This document may include preliminary concepts that may or may not be in the process of being developed by the Tari community. The release of this document is intended solely for review and discussion by the community of the technological merits of the potential system outlined herein.

Goals

This document describes the specific protocol Tari uses to merge mine with Monero.

Related Requests for Comment

Introduction

Tari employs a hybrid mining strategy, accepting 2 mining algorithms whose difficulties are independent of each other as discussed in RFC-0131_Mining.html. This RFC details a protocol to enable Tari to accept Monero proof of work, enabling participating miners a chance to produce a valid block for either or both chain without additional mining effort.

The protocol must enable a Tari base node to make the following assertions:

REQ 1. The achieved mining difficulty exceeds target difficulty as dictated by Tari consensus,

REQ 2. The Monero block was constructed after the current Tari tip block. This is to prevent a miner from submitting blocks from the parent chain that satisfy the auxiliary chain's difficulty without doing new work.

It's worth noting that a Tari base node never has to contact or download data from Monero to make these assertions.

Merge Mining on Tari

A new Tari block template is obtained from a Tari base node by calling the get_new_block_template gRPC method, setting Monero as the chosen PoW algorithm.

The Monero algorithm must be selected so that the correct mining difficulty for the Monero algorithm is returned. Remember, that Monero and SHA difficulties

are independent (See RFC-0131_Mining.html). Next, a coinbase transaction is requested from a Tari Wallet for a give height by calling

the get_coinbase gRPC function.

Next, the coinbase transaction is added to the new block template and passed back to the base node for the new MMR roots to be calculated.

Furthermore, the base node constructs a Blake256 hash of some of the Tari header fields. We'll call this hash the merge mining hash \( h_m \) that commits to

the following header fields in order: version, height,prev_hash,timestamp,input_mr, output_mr,output_mmr_size,kernel_mr,

kernel_mmr_size,total_kernel_offset,total_script_offset. Note, this hash does not include the pow and nonce fields, as these fields are set as part of mining.

To have the chance of mining a Monero block as well as a Tari block, we must obtain a new valid monero block template, by calling get_block_template.

This returns a blocktemplate_blob, that is, a serialized Monero block containing the Monero block header, coinbase and a list of hashes referencing the

transactions included in the block. Additionally, a blockhashing_blob is a fixed size blob containing serialized_monero_header, merkle_tree_root and

txn_count concatenated together. The merkle_tree_root is a merkle root of the coinbase + the transaction hashes contained in the block.

pub struct Block {

/// The block header

pub header: BlockHeader,

/// Coinbase transaction a.k.a miner transaction

pub miner_tx: Transaction,

/// References to the transactions included in this block

pub tx_hashes: Vec<hash::Hash>,

}fig 1. The Monero block struct

Next, modify the Monero block template by including the merge mining hash \( h_m \) in the extra fields of the coinbase transaction. Monero has a merge mining subfield

to accommodate this data. Importantly, the extra field data part of the coinbase transaction hash and therefore the merkle_tree_root, the blockhashing_blob must be

reconstructed. A rust port of Monero's tree hash algorithm is needed to achieve this. The coinbase hash MUST be the first element to be hashed when constructing the merkle_tree_root.

This satisfies REQ 2, proving that the proof-of-work was performed for the Tari block.

The block may now be mined. Once a solution is found that satisfies the Tari difficulty, the miner must include enough data to allow the Tari blockchain to assert REQ 1 and REQ 2.

Concretely, A miner must serialize MoneroPowData using Monero consensus encoding and add it to the pow_data field in the Tari header.

pub struct MoneroPowData {

/// Monero header fields

header: MoneroBlockHeader,

/// randomX vm key

randomx_key: FixedByteArray, // Fixed 64 bytes

/// transaction count

transaction_count: u16,

/// transaction root

merkle_root: MoneroHash,

/// Coinbase merkle proof hashes

coinbase_merkle_proof: MerkleProof,

/// Coinbase tx from Monero

coinbase_tx: MoneroTransaction,

}fig 2. Monero PoW data struct serialized in Tari blocks

pub struct MerkleProof {

branch: Vec<Hash>,

depth: u16,

path_bitmap: u32,

}fig 3. Merkle proof struct

A verifier may now check that the coinbase_tx contains the merge mining hash \( h_m \), and validate the coinbase_merkle_proof against the transaction_root.

The coinbase_merkle_proof contains the minimal proof required to construct the transaction_root.

For example, a proof for a merkle tree of 4 hashes will require 2 hashes (h_1, h_23) of 32 bytes each, 4 bytes for the path bitmap and 2 bytes for the depth.

Root*

/ \

h_c1* h_23

/ \

h_c* h_1

* Not included in proof

Serialisation

For Monero proof-of-work, Monero consensus encoding MUST be used to serialize the MoneroPowData struct. Given the same inputs,

this encoding will byte-for-byte the same. The encoding uses VarInt for all integer types, allowing byte-savings, in particular

for fields that typically contain small values. Importantly, extra bytes that a miner could tack onto the end of the pow_data field

are expressly disallowed.

Merge Mining Proxy

The Tari merge mining proxy proxies the Monero daemon RPC interface. It behaves as a middleware that implements the merge mining protocol detailed above. This allows existing Monero miners to merge mine with Tari without having to make changes to mining software.

The proxy must be configured to connect to a monerod instance, a Tari base node, and a Tari console wallet. Most requests

are forwarded "as is" to monerod, however some are intercepted and augmented before being returned to the miner.

get_block_template

Once monerod has provided the block template response, the proxy retrieves a Tari block template and coinbase,

and assembles the Tari block. The merge mining hash \( h_m \) is generated and added to the Monero coinbase. The modified

blockhashing_blob and blocktemplate_blob are returned to the miner. The difficulty is set to min(monero_difficulty, tari_difficulty)

so that the miner submits the found block at either chain's difficulty. The Tari block template is cached for later submission.

submit_block

The miner submits a solved Monero block (at a difficulty of min(monero_difficulty, tari_difficulty)) to the proxy. The cached

Tari block is retrieved, enriched with the MoneroPowData struct and submitted to the Tari base node.

Change Log

| Date | Change | Author |

|---|---|---|

| 26 Oct 2022 | Stablise RFC | CjS77 |

| 21 Oct 2022 | Update fields | Cifko |

RFC-0140/SyncAndSeeding

Synchronizing the Blockchain: Archival and Pruned Modes

Maintainer(s): S W van Heerden

Licence

Copyright 2022 The Tari Development Community

Redistribution and use in source and binary forms, with or without modification, are permitted provided that the following conditions are met:

- Redistributions of this document must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the copyright holder nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

THIS DOCUMENT IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS", AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT HOLDER OR CONTRIBUTORS BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA OR PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, STRICT LIABILITY OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Language

The keywords "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY" and "OPTIONAL" in this document are to be interpreted as described in BCP 14 (covering RFC2119 and RFC8174) when, and only when, they appear in all capitals, as shown here.

Disclaimer

This document and its content are intended for information purposes only and may be subject to change or update without notice.

This document may include preliminary concepts that may or may not be in the process of being developed by the Tari community. The release of this document is intended solely for review and discussion by the community of the technological merits of the potential system outlined herein.

Goals

This Request for Comment (RFC) describes the syncing and pruning process.

Related Requests for Comment

Descriptions

Syncing

When a new node comes online, loses connection or encounters a chain reorganization that is longer than it can tolerate, it must enter syncing mode. This will allow it to recover its state to the newest up-to-date state. Syncing can be divided into two SynchronizationStrategys: complete sync and horizon sync. Complete sync means that the node communicates with an archive node to get the complete history of every single block from genesis block. Horizon Sync involves the node getting every block from its pruning horizon to current head, as well as every block header up to the genesis block.

To determine if the node needs to synchronise, the node will monitor the broadcasted chain_metadata messages provided by its neighbours. The fields in the chain_metadata messages MUST be:

| Field | Description |

|---|---|

| height_of_longest_chain | 64-bit unsigned |

| best_block | hash of the tip block (32-bit) |

| pruning_horizon | 64-bit unsigned |

| pruned_height | 64-bit unsigned |

| accumulated_difficulty | 128-bit unsigned |

| timestamp | 64-bit unsigned |

Complete Sync

Complete sync is only available from archival nodes, as these will be the only nodes that will be able to supply the complete history required to sync every block with every transaction from genesis block up onto current head.

Complete Sync Process

Once the base node has determined that it is lagging behind the network tip it will start to synchronise with the peer it determines to have all the data required to synchronise.

The syncing process MUST be done in the following steps:

- Set SynchronizationState to

header_sync. - Sync all missing headers from the genesis block to the current chain tip. The initial header sync allows the node to confirm that the syncing peer does indeed have a fully intact chain from which to sync that adheres to this node's consensus rules and has a valid proof-of-work that is higher than any competing chains.

- Set SynchronizationState to

block_sync. - Start downloading blocks from sync peer starting with the oldest block in our database. A fresh node will start from the genesis block.

- Download all block up to current head, validating and adding the blocks to the local chain storage as we go.

- Once all blocks have been downloaded up and including the current network tip set the SynchronizationState to

listening.

After this process, the node will be in sync, and will be able to process blocks and transactions normally as they arrive.

Horizon Sync Process

The horizon sync process MUST be done in the following steps:

- Set SynchronizationState to

header_sync. - Sync all missing headers from the genesis block to the current chain tip. The initial header sync allows the node to confirm that the syncing peer does indeed have a fully intact chain from which to sync that adheres to this nodes consensus rules and has a valid proof-of-work that is higher than any competing chains.

- Set SynchronizationState to

horizon_sync. - Download all kernels from the current network tip back to this node's pruning horizon.

- Validate kernel MMR root against headers.

- Download all utxo's from the current network tip back to this node's pruning horizon.

- Validate outputs and utxo MMR.

- Validate the chain balances with the expected total emission that the final sync height.

- Once all kernels and utxos have been downloaded from the network tip back to this node's pruning horizon set

the SynchronizationState to

block_sync. This hands over further syncing to the standard sync protocol which should return to thelisteningstate if no further data has been received from peers.

After this process, the node will be in sync, and will be able to process blocks and transactions normally as they arrive.

Keeping in Sync

The node that is in the listening state SHOULD periodically test a subset of its peers with ping messages to ensure